‘Tis the Season for Charitable Contributions

As 2014 comes to a close, here are a few tips to make sure you don’t miss out on the tax deduction for your charitable contributions:

- The IRS requires written acknowledgement from organizations for gifts worth $250 or more.

- Keep bank records or written statements from organizations, regardless of the amount donated.

- Make sure that the organization qualifies as exempt under IRC 501(c)(3). Click here to verify your organization’s exempt status:

- Mail your donation checks by December 31, 2014. If you make a donation via credit card in 2014, but don’t pay the bill until 2015, the amount is considered deductible for 2014.

- If you’ve donated a vehicle valued at more than $500, the deduction may be limited to the gross proceeds from its sale

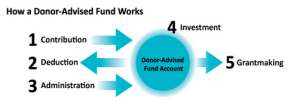

For those of you feeling especially generous this holiday season, consider contributing to donor-advised fund (DAF). Donors contribute a minimum (usually $5,000) to their account and get an immediate tax deduction. Now, the donor has the right to recommend grants to his or her favorite charitable organizations and to contribute to the DAF throughout the year.

DAF are a great way to increase your support of charitable organizations, since your investment earns interest tax-free. Your grants will be distributed to organizations throughout the year, helping them with cash flow management and ensuring that projects and initiatives drive funding, not year-end planning.

Contact us at Franty & Company to make sure your 2014 charitable giving counts!