Roth IRA Conversions

We speak with a lot of folks saving for their retirement and they often ask us if we think they’re saving enough. “How much is enough” is a question for another day, but we do want to talk about an interesting retirement savings strategy that many folks are utilizing – Roth IRA Contributions.

We all like to have our cake and eat it, too. With retirement and tax savings, you don’t get to do that, but the closest you can get to it is with the Roth IRA. There is no upfront tax deduction for Roth IRA contributions (Boo!), BUT earnings inside your Roth IRA grow completely tax free AND distributions from your Roth IRA are tax-free if you take them after you reach 59 ½ (YAY!!). That’s some pretty tasty cake right there.

There are no mandatory withdrawals, unlike with traditional IRAs which require distributions when the account holder reaches age 70 ½ (and those withdrawals are generally taxable for federal income tax purposes). Lastly, regardless of your age and as long as you have earned income (salaries, wages or self-employment income), you can continue to contribute to your Roth IRA.

Taxpayers can contribute up to $5,500 a year to Roth IRA accounts if their income falls within the IRS rules. Single taxpayers with Adjusted Gross Income (“AGI”) of $116,000 or less and joint filers with AGI of $183,000 or less can contribute the maximum. The catch-up provisions for folks over the age of 50 increase that contribution amount to $6,500 per year.

Single taxpayers with AGI between $116,001 and $131,000 and joint filers with AGI between $183,001 and $193,000 can contribute to Roth IRAs, but their contributions are limited. Taxpayers with AGI over $131,000 (single) and $193,000 (joint) are not eligible to contribute to a Roth IRA account.

IF your income is over the IRS limits and you still want to reap the benefits of a Roth IRA, well, we may have some very good news for you, friends. You may not be out of luck!

One of our favorite retirement saving techniques is to execute a Roth Conversion or a Backdoor Roth Contribution. It’s strictly legit, it’s a great way to save for retirement, and you don’t have to make mandatory distributions six months after your 70th birthday. There are additional benefits inherent in Roth IRAs that we’ll go over a bit later.

The basics of the Roth Conversion are as follows: The taxpayer makes a nondeductible Traditional IRA contribution in the current tax year. In the following tax year, the Traditional IRA is converted to a Roth IRA account. The taxpayer will be required to pay tax on any increase in the IRA’s value from the contribution date to the conversion date.

If the initial contribution was $5,000 and it was made in the preceding November, and the account value when it was converted to the Roth in the next February (four plus months later) was $5,050, the taxpayer would realize taxable income of $50. The tax would be paid in the following tax year with the filing of your tax return.

After the conversion, $5,050 has been contributed into a Roth IRA where the funds will grow tax free and distributions will be tax free, even though the taxpayer’s income exceeded the Roth IRA contribution levels. While the IRS mandates income thresholds for Roth IRA contributions, there are no income maximums for Roth conversions.

There are of course some caveats, provisos, and technical rules to be aware of before executing a Roth conversion. It wouldn’t be a tax related post without some mention of the Internal Revenue Code!

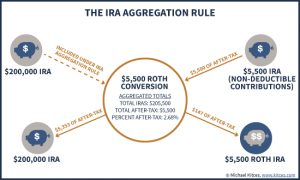

The IRA Aggregation Rule (§408(d)(2)) can trip up the benefits of a Roth Conversion. This section of the Code stipulates that when a taxpayer holds multiple IRAs, they will ALL be treated as one account when determining the taxability of distributions, including the Roth Conversion).

If you’d like to do the backdoor Roth strategy, but already have other existing IRA accounts (prior year deductible IRA contributions or a rollover from an old 401k account), the IRA Aggregation rule can pose a challenge. The IRC states that for IRA distributions (including Roth Conversions) any after-tax contributions are distributed along with pre-tax assets (contributions or growth) on a pro-rata basis, because all the accounts are aggregated together. It’s impossible to only convert the non-deductible IRA.

(Image sourced from www.kitces.com)

We’re saying these technical tax accountant things and you’re probably reading them like we’re saying blah-blah-blah-blah-blah-blah. So here’s the bottom line about IRA aggregation rules. The aggregation rules:

- Do not aggregate a husband and wife’s IRA accounts;

- Do not aggregate inherited IRA accounts; and

- Employer retirement plans (401k’s, SEPs, etc) and any existing Roth IRA’s are excluded from the aggregation rules.

If you have an existing Traditional IRA, this strategy may be challenging from a tax perspective. If you have retirement savings only in an employer’s 401k plan and your earnings exceed the limits discussed above, then this strategy could be extremely useful to you.

We mentioned above that there are other benefits that accrue to Roth IRA owners. Here is a brief summary of some of those benefits:

- Distributions (post age 59 ½) are completely tax free;

- Certain Roth distributions (disability, medical expenses, first time home purchase, education expenses, etc) taken before attaining age 59 ½ are also tax free;

- You can contribute to a Roth even after attaining the age of 70 ½ ; and

- When you die, any distributions from your Roth IRA to the beneficiaries will be completely tax free.

That’s powerful stuff, folks. Let that sink in for a minute – your beneficiaries (children and grandchildren) will receive their distributions from your Roth IRA completely tax free. That. Is. Awesome.

The second potential road block for the Roth Conversion is the “step transaction doctrine.” Simply put, the IRS can and has looked at separate steps of a transaction and determined that the separate steps are actually one, integrated tax event.

For a Roth Conversion, if the steps are taken too close to one another, there is a risk that the IRS may look into the transaction and disallow the Roth contribution, imposing an excess contribution penalty of 6%. This is why we recommend a time gap between the initial non-deductible Traditional IRA contribution and the Roth conversion. Some practitioners believe that 30 days is long enough, while others wait as long as 12 months before executing the conversion. The time lag we used in our example covers about four months and two separate tax years so we believe it to be a reasonable time period that addresses the step transaction doctrine.

In summary, Roth IRA’s are excellent retirement planning vehicles with exceptional additional benefits AND even if your income level phases you out of Roth IRA participation, the Roth Conversion allows you to take advantage of the Roth IRAs benefits. Let us know if we can be of assistance in your implementation of this terrific tax and wealth planning strategy! We can help.