2014 Social Security & Medicare News You Can Use

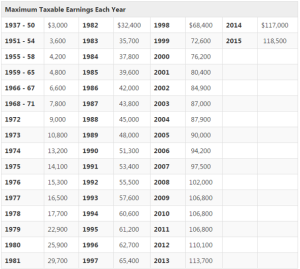

The Social Security wage base will increase in 2014 to $117,000, a $3,300 bump over the current level of $113,700. The OASDI tax rate, or FICA tax rate, paid by both employers and employees will stay at 6.2%. The Medicare tax rate will also remain stable in 2014 at 1.45% (paid both by employers and employees); there is no cap on the medicare tax (it’s paid on all employee wages).

In addition, the 0.9% Medicare surtax kicks in on single taxpayers with wages exceeding $200,000 and married wage earners with compensation over $250,000. While the surtax is not matched by employers it is required to be paid by self-employed persons with earnings at the above limits.

Social Security benefits will be increases by 1.5% in 2014; the increase is slightly less than the bump that Social Security recipients saw for 2013.

Earnings limits for Social Security recipients will go up in 2014. People who turn 66 next year will NOT lose any benefits if they earn less than $41,400. Also in 2014, Individuals between the ages of 62 and 66 can make up to $15,480 before they lose any of their Social Security benefits. There is no earnings cap once a recipient turns 66 years of age.

The basic Medicare Part B premium will remain $104.90 per month in 2014 but upper-income seniors (defined as couples with modified adjusted gross income (“MAGI”) over $170,000 or singles with MAGI over $85,000) STILL have to pay higher Part B and D premiums (I know, Bummer).

A little accounting lingo here for you, folks: MAGI is Adjusted Gross Income plus any tax exempt interest, EE Bond Interest used for educational purposes and excluded foreign earned income. Doesn’t affect a lot of folks.

The Part B surcharge for 2014 won’t change and the Part D charge will rise slightly. Total surcharges on upper income earners can be as high as $300.10 per month.

Give us a call if you are concerned about these changes. We can help!